UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule | |

| Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material |

Cambria ETF Trust

_______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee | |||

☐ | ||||

Fee paid previously with preliminary | ||||

☐ | ||||

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||||

CAMBRIA ETF TRUST2321 Rosecrans3300 Highland AvenueSuite 3225El Segundo,Manhattan Beach, California 9024590266

May 31, 2018June 22, 2023

Dear Shareholder:

On January 24, 2018, Eric Richardson,Since the Presidentinception of each series of the Cambria ETF Trust (the “Trust”) (each, a “Fund” and, an Interested Trusteecollectively, the “Funds”), Cambria Investment Management, L.P. (“Cambria” or the “Adviser”) has served as each Fund’s investment adviser. Subject to the oversight of the Board of Trustees of the Trust (the “Board”) since, Cambria is responsible for the Trust’s organization in 2011, passed away. He was also the chief executive officermanagement and a co-founder and controlling owner of Cambria Investment Management, L.P. (the “Adviser”), the investment adviser to each seriesbusiness affairs of the Trust (each, a “Fund”Funds and collectively,has discretion to purchase and sell securities in accordance with the “Funds”). Mr. Richardson hadFunds’ objectives, policies, and restrictions. Cambria also served as a portfolio managercontinuously reviews, supervises, and administers the Funds’ investment programs. In addition to each Fund since its inception. His death resulted in the transfer of his ownership interests in the Adviser. This change in controlproviding these core functions of the Adviser,adviser, Cambria also provides other investment advisory services to the Funds, such as executing trades for the Funds’ portfolio securities and selecting broker-dealers to execute these trades. As Cambria’s business grows, Cambria believes that the Funds and their shareholders would benefit from Cambria delegating these trading services to an unaffiliated sub-adviser that has extensive experience providing these trading services to exchange-traded funds. This, in turn, triggeredwould allow Cambria to focus its attention more specifically and more effectively on its core business: managing the assignmentFunds’ investment strategies and automatic terminationselecting the Funds’ investments.

Accordingly, on behalf of each existing investment advisory agreement between the Adviser and the Trust.

As a result,Board, I am writing to inform you of an upcoming Special Meetinga special meeting of Fund Shareholders (theshareholders of each series of the Trust (together with any postponements or adjournments, the “Meeting”). The Meeting is scheduled to that will be held at 10:00 a.m. Pacific Time on June 22, 2018,July 14, 2023, at the Trust’s offices of Cambria, located at 2321 Rosecrans3300 Highland Avenue, Suite 3225, El Segundo,Manhattan Beach, California 90245. Please vote for each of the items listed on the ballot for this Meeting.90266. At the Meeting, you are beingwill be asked to:

(1) elect new independent trustees to (1)the Board;

(2) approve a new investment advisorysub-advisory agreement between the Trust, on behalfCambria and Toroso Investments, LLC with respect to each Fund; and

(3) approve a manager of managers arrangement for each Fund and the Adviser (the “New Agreement”), and (2) elect Mebane T. Faber as a Trusteethat would grant Cambria, subject to the Board.

At a meeting held on March 14, 2018,prior approval by the Board, unanimously approvedgreater flexibility to enter into and materially amend agreements with unaffiliated sub-advisers without obtaining the New Agreement, which includes terms and compensation payable to the Adviser that areidentical to the terms and compensation set forth in the Funds’ prior investment advisory agreement. Further, atapproval of a meeting held on February 7, 2018, the Board appointed Mr. Faber to serve as the Trust’s President and as an Interested Trustee. Mr. Faber, the chief investment officer and co-founder of the Adviser and portfolio manager to each of the Funds since their inception, served as the Trust’s Vice President prior to Mr. Richardson’s death.

The Board of Trustees of the Trust unanimously recommends that you vote in favor of each proposal.Fund’s shareholders.

Enclosed are a notice of the Meeting, and a proxy statement that includes detailed information about each proposal. proposal, and a proxy card with instructions for voting. In addition, you will find questions and answers regarding the proxy statement that are designed to help you understand the proxy statement and how to cast your votes. These questions and answers are being provided as a supplement to, not a substitute for, the proxy statement, which we urge you to review carefully.

If you have received this mailing, you are a Fund shareholder of record of one or more Funds as of the close of business on May 25, 2018,June 1, 2023, and you are entitled to vote at the Meeting, and any adjournment ofMeeting. The Board recommends that you vote FOR each proposal, including FOR each Trustee nominee. For additional information about the Meeting.proposals, please see the accompanying proxy statement.

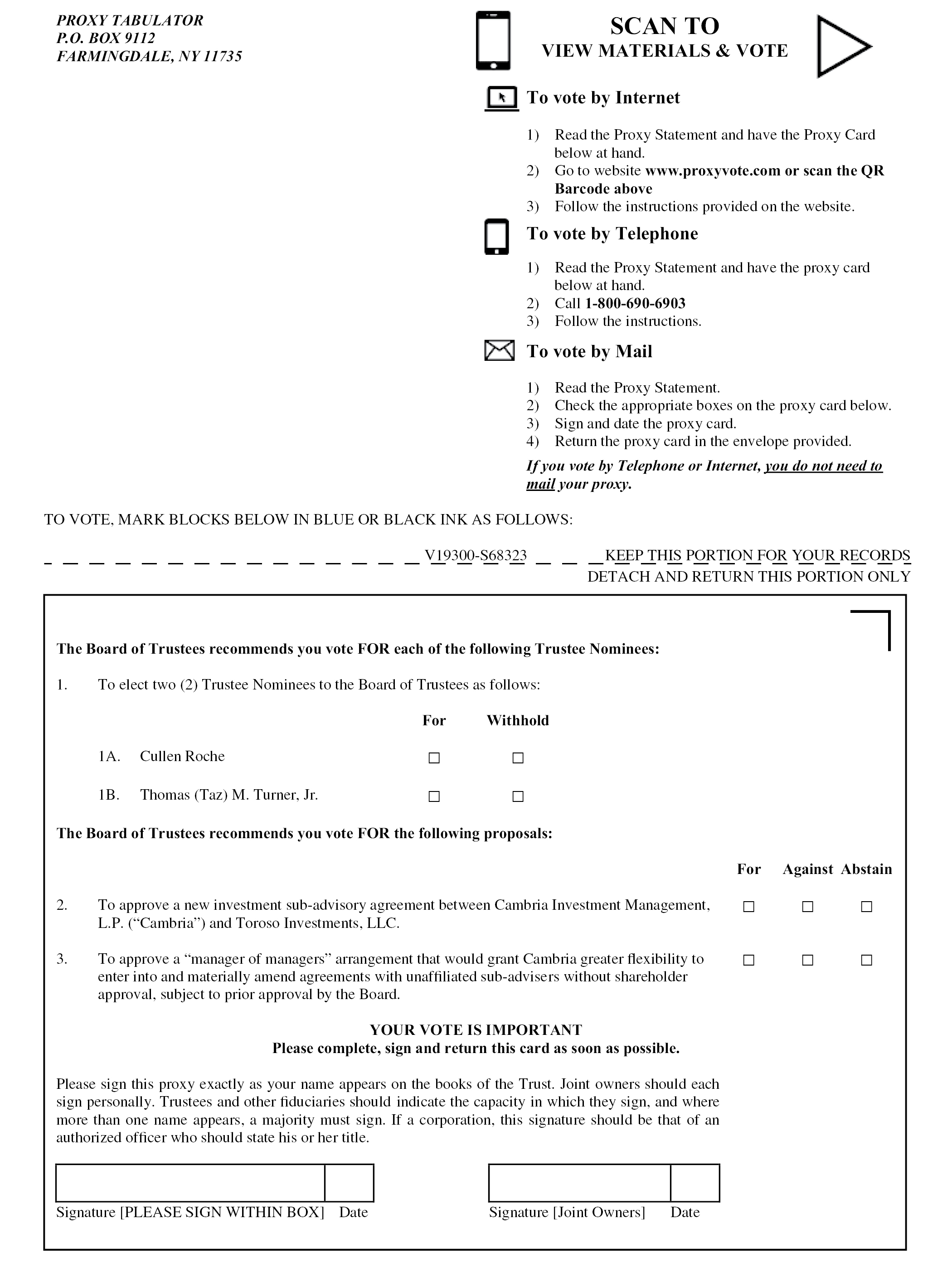

Your vote is very important to us regardless of the number of shares you own.You can vote any one of these four ways:

• Through the website listed on the proxy voting instructions enclosed;

• By telephone using the toll-free number listed in the proxy voting instructions;

• By mail with the enclosed proxy card — be sure to sign, date and return it in the enclosed postage-paid envelope; or

• In person at the shareholder meeting on July 14, 2023 at 10:00 a.m. Pacific Time.

Please note that no changes are being proposed to any of the Funds’ management fees or expense ratios.

In order to avoid the added cost of follow-upfollow-up solicitations and possible adjournments, please read the enclosed proxy statement carefully and vote your shares today.You are encouraged to vote by telephone or through the Internet using the control number that appears on the enclosed proxy card. Use of telephone or Internet voting will reduce the time and costs associated with this proxy solicitation. You can also vote your shares by attending the Meeting in person. If your Fund shares are held in “street name” by your broker dealer, you will need to obtain a “legal proxy” from your broker dealer and present it at the Meeting in order to vote your shares in person.

In addition, while we intend to hold the Meeting in person, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Meeting attendees or may decide to hold the Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on the website listed on the enclosed proxy voting instructions, and we encourage you to check this website prior to the Meeting if you plan to attend.

If we do not receive your vote promptly, you may be contacted by a Fund representative, who will remind you to vote your shares.

Thank you for your attention and consideration of this important matter and for your investment in the Funds. If you have questions, please call 866-963-6135the Funds’ proxy solicitor, Broadridge Financial Solutions, Inc., toll-free at (888) 490-5095 between Monday and Friday from 9:00 a.m. to 10:00 p.m., Eastern Time, for additional information.

Sincerely,

Mebane T. Faber

President

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAIDSELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE, SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

CAMBRIA ETF TRUST2321 Rosecrans3300 Highland AvenueSuite 3225El Segundo,Manhattan Beach, California 9024590266

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 22, 2018JULY 14, 2023

Notice is hereby given that a Special Meetingspecial meeting of Shareholdersshareholders (the “Meeting”) of each series (each, a “Fund”) of Cambria ETF Trust (the “Trust”), will be held at 10:00 a.m. Pacific Time on June 22, 2018,July 14, 2023, at the Trust’s offices of Cambria Investment Management, L.P. (“Cambria” or the “Adviser”), located at 2321 Rosecrans3300 Highland Avenue, Suite 3225, El Segundo,Manhattan Beach, California 90245.90266.

At the Meeting, shareholders of record of each Fund will be asked to vote on the following proposals with respect to each Fund in which they own shares:

1. to elect new independent trustees to the Board of Trustees of the Trust (the “Board”);

2. to approve a new investment sub-advisory agreement between Cambria and Toroso Investments, LLC with respect to each Fund (the “Sub-Advisory Agreement”); and

3. to approve a manager of managers arrangement for each Fund that would grant Cambria, subject to prior approval by the Board, greater flexibility to enter into and materially amend agreements with unaffiliated sub-advisers without obtaining the approval of a Fund’s shareholders (the “Manager of Managers Proposal”).

Shareholders of the Funds may also be asked to transact such other business as may properly come before the Meeting or any adjournments thereof.

After careful consideration, the Board of Trustees unanimously recommends that you vote “FOR” each of the proposals.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held on July 14, 2023.

The proxy statement is available online at www.proxyvote.com.

Shareholders of record of the Fund at the close of business on May 25, 2018June 1, 2023 are entitled to notice of, and to vote at, the Meeting or any adjournment thereof. Shareholders of each Fund will vote separately from shareholders of each other Fund with respect to the new investment advisory agreement.Sub-Advisory Agreement and the Manager of Managers Proposal. Shareholders of each Fund in the Trust, however, will vote together as a group with respect to the election of Mr. Faber as a Trustee.the new independent trustees.

All shareholders are cordially invited to attend the Meeting and vote in person. If your Fund shares are held in “street name” by your broker dealer, you will need to obtain a “legal proxy” from your broker dealer and present it at the Meeting in order to vote your shares in person. However, if you are unable to attend the Meeting, you are requested to mark, sign and date the enclosed proxy card and return it promptly in the

enclosed, postage-paidpostage-paid envelope so that the Meeting may be held and a maximum number of shares may be voted. In addition, you can vote easily and quickly by Internet or by telephone.Your vote is important no matter how many shares you own.You may change your vote even though a proxy has already been returned by providing written notice to the Trust, by submitting a subsequent proxy by mail, Internet or telephone, or by voting in person at the Meeting.

In addition, while we intend to hold the Meeting in person, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Meeting attendees or may decide to hold the Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on the website listed on the enclosed proxy voting instructions, and we encourage you to check this website prior to the Meeting if you plan to attend.

If you should have any questions regarding the enclosed proxy material or need assistance in voting your shares, please contact your financial representative or call the TrustFunds’ proxy solicitor, Broadridge Financial Solutions, Inc., toll-free at 866-963-6135.(888) 490-5095 between Monday and Friday from 9:00 a.m. to 10:00 p.m., Eastern Time.

Important Notice RegardingBy Order of the AvailabilityBoard of Proxy Materials for the Shareholder Meeting to be Held onTrustees,

Mebane T. Faber

President

Dated: June 22, 2018.2023

The proxy statement is available at www.proxy-direct.com/cam-29973.

|

|

Dated: May 31, 2018

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF VOTES YOU HOLD. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR INTERNET BY FOLLOWING THE ENCLOSED INSTRUCTIONS. IF YOU VOTE BY TELEPHONE OR VIA THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD UNLESS YOU ELECT TO CHANGE YOUR VOTE.

IMPORTANT NEWS FOR SHAREHOLDERS

While we encourage you to read the full text of the enclosed proxy statement, for your convenience herebelow is a brief overview of the matters that require your vote as a shareholder of one or more series of Cambria ETF Trust (the “Trust”).

QUESTIONS AND ANSWERS

iQ. Why am I being asked to vote on a sub-advisory agreement for the Funds?

A. Cambria Investment Management, L.P. (“Cambria” or the “Adviser”) desires to engage Toroso Investments, LLC (“Toroso”) to provide certain sub-advisory services to each series of the Trust (each, a “Fund” and, collectively, the “Funds”), namely trading portfolio securities (and other financial instruments) for the Funds, including the selection of broker-dealers to execute the Funds’ purchase and sale transactions. In addition, Toroso will be delegated the authority to vote proxies on behalf of the Funds. Cambria will retain responsibility for the day-to-day active management of the Funds’ strategies and the individual selection of investments for each Fund’s portfolio. As a Fund shareholder, you are entitled to vote on the new investment sub-advisory agreement between Cambria and Toroso with respect to your Fund(s) (the “Sub-Advisory Agreement”).

Toroso, located at 898 N. Broadway, Suite 2, Massapequa, New York 11758, is an SEC-registered investment adviser and a Delaware limited liability company. Toroso is branded as part of Tidal Financial Group, and Toroso is the parent company of Tidal ETF Services LLC. Toroso was founded in, and has been managing investment companies since, March 2012. Toroso is dedicated to understanding, researching and managing assets within the expanding exchange-traded fund (“ETF”) universe. As of March 31, 2023, Toroso had assets under management of approximately $6.2 billion and served as the investment adviser or sub-adviser for 97 registered funds.

At a meeting held on March 7, 2023, the Board of Trustees of the Trust (the “Board”) voted to approve the Sub-Advisory Agreement, subject to shareholder approval. One of the Trust’s two independent trustees, Michael Venuto abstained from voting on the approval because he was a co-founder of, serves as chief investment officer of, and owns equity in, Toroso; however, the other independent trustee, Dennis Schmal, voted to approve the proposed sub-advisory arrangement. Pursuant to Section 15(a) of the Investment Company Act of 1940 (the “1940 Act”), the Sub-Advisory Agreement must also be approved by the vote of a majority of a Fund’s outstanding voting securities for Toroso to provide sub-advisory services to that Fund. Accordingly, you, as a Fund shareholder, are being asked to vote on the approval of the Sub-Advisory Agreement with respect to your Fund(s).

iiQ. How will the Sub-Advisory Agreement affect me as a shareholder?

A. The Sub-Advisory Agreement should not affect you as a shareholder. Cambria will continue to provide advisory services to each Fund on the same terms, and at the same advisory fee rate, as Cambria currently provides. Under the terms of the Sub-Advisory Agreement, Cambria will pay Toroso a fee out of the management fee Cambria receives from the Funds. The Funds’ fees will not increase as a result of the approval of the Sub-Advisory Agreement. The engagement of Toroso to handle certain of these advisory services, such as the trading of Funds’ portfolio securities and the selection of broker-dealers to execute these trades, however, will enable Cambria to focus its attention more specifically and more effectively on the management of the Funds’ investment strategies and the selection of Fund investments. Cambria has assured the Board that there will be no change in the extent, nature or quality of the investment advisory services provided to each Fund. In addition, the Funds’ portfolio manager, Mebane Faber, will remain unchanged.

Q. What happens if the Sub-Advisory Agreement is not approved?

A. If the Sub-Advisory Agreement is not approved by Fund shareholders, Cambria will continue to provide all investment advisory services to the Funds, including all portfolio trading services, and the Board will consider what further action is in the best interests of the Funds and their shareholders, including, but not limited to, resubmitting the Sub-Advisory Agreement to shareholders for approval or requesting shareholder approval for a different investment sub-advisory agreement.

Q. Why is the Board composition changing?

A. The Trust’s Board is currently comprised of three trustees, one “interested” trustee, as such term is defined in the 1940 Act, and two independent trustees. One of the Board’s current independent trustees, Michael Venuto, is the co-founder and chief investment officer of Toroso as well as an equity owner of Toroso. As a result, if Toroso becomes an investment sub-adviser to one or more Funds, Mr. Venuto will become an “interested” trustee within the meaning of the 1940 Act. Given his relationship with Toroso, Mr. Venuto has submitted, and the Board has accepted, his resignation as a Trustee, which will become effective upon the election of a new independent trustee (as described below). With Mr. Venuto resigning as a Trustee, the Board would be left with two trustees — one interested trustee and one independent trustee. While this is permissible under the 1940 Act, Cambria and the Board believe that it is in the best interest of the Funds and their respective shareholders to elect additional independent trustees. Not only will this provide the Board with additional resources and expertise, but it will also provide two additional trustees that are independent of Cambria and Toroso.

Q. Why am I being asked to vote to elect a Trustee?

A. The 1940 Act generally requires that, upon the filling of any vacancy in the board, at least two-thirds of a fund’s directors be elected by the fund’s shareholders. As noted above, Cambria and the Board believe it is in the best interest of the Funds and their shareholders to elect two additional independent trustees. Accordingly, you, as a shareholder of a Fund, are being asked to vote on the election of two new independent trustees as part of this proxy statement.

Q. Who are the two independent trustee nominees?

A. After considering each of the nominees’ qualifications, backgrounds, attributes, skills, and experience, as set forth in greater detail in the proxy statement, the Board has nominated the following individuals to serve as independent trustees of the Trust:

• Cullen Roche — founder and chief investment officer of the Discipline Funds

• Thomas (Taz) M. Turner, Jr. — founder and portfolio manager of Southshore Capital Partners

Q. What is the Manager of Managers Proposal?

A. The Manager of Managers Proposal relates to a type of exemptive relief (a “Manager of Managers Order”) granted by the Securities and Exchange Commission (the “SEC”), subject to the approval of a majority of a Fund’s outstanding voting securities. If a Fund’s shareholders approve the Manager of Managers Proposal and the SEC grants such relief, the Manager of Managers Order will allow such Fund to retain a new unaffiliated sub-adviser or make material changes to an existing sub-advisory agreement, each without shareholder approval. While shareholders would no longer have the right to vote on the hiring of unaffiliated sub-advisers, approval of this proposal should, subject to the Trust receiving the relief sought from the SEC, result in certain benefits to the Funds, including the avoidance of unnecessary costs associated with a shareholder meeting and proxy solicitation each time Cambria wishes to hire or change an unaffiliated sub-adviser or otherwise materially amend a sub-advisory agreement. If the Manager of Managers Proposal is approved, Cambria, on behalf of the Trust, will seek a Manager of Managers Order from the SEC. If granted, a Fund will need to adhere to certain conditions to rely on the order. For example, within 90 days after a change to a Fund’s sub-advisory arrangement, such Fund must provide shareholders with an information statement that contains information about the sub-adviser and sub-advisory agreement that would otherwise be contained in a proxy statement. In addition, a majority of the Board must consist of Independent Trustees and the nomination of new or additional Independent Trustees must be at the discretion of the then-existing Independent Trustees. A Fund must also disclose the existence, substance, and effect of the Manager of Managers

Order and certain details of such arrangement in its prospectus. Further, any new sub-advisory arrangement or any amendment to an existing advisory or sub-advisory agreement that, directly or indirectly, results in an increase in the aggregate advisory fee rate payable by a Fund must be submitted to that Fund’s shareholders for approval.

Q. Why should shareholders approve the Manager of Managers Proposal?

A. Absent this relief from the SEC, a Fund would be required to obtain shareholder approval each time such Fund desired to hire or change a sub-adviser. This process can be long and costly. If shareholders approve the Manager of Managers Proposal, and the Trust receives a Manager of Managers Order from the SEC, Cambria would be permitted to recommend and hire a broader universe of sub-advisers in a cost-effective and timely manner, which the Board believes will benefit the Funds and their shareholders. Further, shareholder interests will continue to be protected because the Board will review and approve all sub-advisory arrangements and will monitor the performance of each sub-adviser on an ongoing basis.

Q. How do the Trustees suggest that I vote?

A. The Board recommends that shareholders of each Fund vote “FOR” each of the proposals and “FOR” each of the independent trustee nominees.

Q. Will my vote make a difference?

A. Yes. Every vote is important, and we encourage all shareholders to participate in the governance of the Funds no matter how many shares they own. Additionally, your immediate response on the enclosed proxy card or by telephone or Internet may help save the costs of further solicitations.

Q. Will my Fund(s) pay for this proxy solicitation?

A. No. Toroso will pay the costs of the shareholder meeting and the expenses incurred in connection with the solicitation of proxies for the Funds up to $500,000. Cambria will pay any such costs and expenses that exceed $500,000. In addition, if the Board, in its sole discretion, determines to not renew the Sub-Advisory Agreement with Toroso after its initial two-year period, or if either the Board or Cambria terminates the Sub-Advisory Agreement prior to its third anniversary, in the absence of material breach on the part of Toroso, Cambria agrees to reimburse Toroso for the costs and expenses associated with the shareholder meeting and solicitation of proxies. The Funds will not pay for this proxy solicitation.

Q. How do I vote?

A. You may provide the Trust with your vote via mail, by Internet, by telephone, or in person. Please follow the enclosed instructions to utilize any of these voting methods.

Q. Whom do I call if I have questions?

A. If you need additional voting information, please call the Funds’ proxy solicitor, Broadridge Financial Solutions, Inc., toll-free at (888) 490-5095 between Monday and Friday from 9:00 a.m. to 10:00 p.m., Eastern Time.

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAIDSELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE, SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

iii

CAMBRIA ETF TRUST2321 Rosecrans3300 Highland AvenueSuite 3225El Segundo,Manhattan Beach, California 9024590266

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 22, 2018 JULY 14, 2023

This proxy statement isand enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Cambria ETF Trust (the “Trust”). The proxy is being solicited for use at thea Special Meeting of Shareholders of each series of the Trust (each, a “Fund” and, collectively, the “Funds”) to be held at 10:00 a.m. Pacific Time on June 22, 2018,July 14, 2023, at the Trust’s offices of Cambria Investment Management, L.P. (“Cambria” or the “Adviser”), located at 2321 Rosecrans3300 Highland Avenue, Suite 3225, El Segundo,Manhattan Beach, California 90245,90266, and at any adjourned sessionand all adjournments or postponements thereof (such Special Meeting(the “Meeting”). This Proxy Statement and any adjournment thereofthe accompanying notice and proxy card are hereinafter referredbeing first mailed to as the “Meeting”).shareholders on or about June 22, 2023.

The Board has called the Meeting and is soliciting proxies from shareholders of each Fund for the purposes listed below:

1. to elect new independent trustees to the Board,

2. to approve a new investment sub-advisory agreement between Cambria and Toroso Investments, LLC (“Toroso” or the “Sub-Adviser”) with respect to each Fund (the “Sub-Advisory Agreement”), and

3. to approve a manager of managers arrangement for each Fund that would grant Cambria, subject to prior approval by the Board, greater flexibility to enter into and materially amend agreements with unaffiliated sub-advisers without obtaining the approval of a Fund’s shareholders (the “Manager of Managers Proposal”).

Shareholders of record of the Fund at the close of business on May 25, 2018June 1, 2023 (the “Record Date”) are entitled to vote at the Meeting.The Board unanimously recommends that shareholders vote “FOR” each proposal.proposal, including FOR the independent trustee nominees. Shareholders of each Fund in the Trust will vote together as a group with respect to Proposal 1, the election of Cullen Roche (Proposal 1A) and Thomas (Taz) M. Turner, Jr. (Proposal 1B) as new trustees. Shareholders of each Fund will vote separately from shareholders of each other Fund with respect to the new investment advisory agreement. ShareholdersProposal 2 (the Sub-Advisory Agreement) and Proposal 3 (the Managers of each Fund in the Trust, however, will vote together as a group with respect to the electionManagers Proposal).

1

Table of Mr. Faber as a Trustee.Contents

This proxy statement and the accompanying notice and proxy card are being mailed to Fund shareholders on or about May 31, 2018.June 22, 2023.

If you should have any questions regarding the enclosed proxy material or need assistance in voting your shares, please contact your financial representative or call the TrustFunds’ proxy solicitor, Broadridge Financial Solutions, Inc., toll-free at 866-963-6135.(888) 490-5095 between Monday and Friday from 9:00 a.m. to 10:00 p.m., Eastern Time.

2

3

PROPOSAL 1: APPROVALELECTION OF THE NEW INVESTMENT ADVISORY AGREEMENTINDEPENDENT TRUSTEES

The Change in Controlpurpose of the Adviser

On January 24, 2018, Eric Richardson, the co-founderthis proposal is to ask shareholders to elect Cullen Roche (“Proposal 1A”) and chief executive officer of Cambria Investment Management, L.P. (the “Adviser”), the investment adviser to each Fund, passed away. Mr. Richardson had served as a portfolio manager to each Fund from its inceptionThomas (Taz) M. Turner, Jr. (“Proposal 1B” and, as an Interested Trustee on the Board and the President of the Trust sincetogether with Proposal 1A, “Proposal 1”) to the Trust’s organization in 2011. In addition, Mr. Richardson wasBoard of Trustees (each, a controlling owner“Nominee” and, together, the “Nominees”).

The Board currently consists of the Adviser. His death resulted in the transferthree Trustees, each of his ownership interests in the Adviser. Although Mr. Richardson’s economic interests in the Adviser transferred to his heirs, his controlling “voting” interest in the Adviser transferred to Mebane Faber—the Adviser’s other co-founder and controlling owner. As a result,whom, except Mr. Faber, becameare independent or disinterested persons within the sole manager of the Adviser’s sole general partner, Cambria GP, LLC. This change in control of the Adviser, in turn, triggered the assignment and automatic termination, pursuant to Section 15(a)(4) of the Investment Company Act of 1940 (“1940 Act”), of each existing investment advisory agreement between the Adviser and the Trust.

In order to continue providing advisory services to the Funds, the Adviser entered into an interim investment advisory agreement with the Trust, on behalf of each Fund (the “Interim Agreement”). The Interim Agreement was approved by the Board, including all of the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”), at a special meeting of the Board on February 7, 2018. Pursuant to Rule 15a-4(b)(1)meaning of the 1940 Act, the material terms and compensation payable to the Adviser under the Interim Agreement are identical to those of the prior advisory agreement that was in place between the Trust and the Adviser immediately preceding the change in control of the Adviser (the “Prior Agreement”), except that the Interim Agreement terminates, with respect to a Fund, upon either shareholder approval of a new advisory agreement for the Fund or the 150th day following the Interim Agreement’s effective date, whichever occurs first. As of the date of this proxy statement, the AdviserAct. A Trustee is providing advisory services to the Funds under the Interim Agreement.

Although Rule 15a-4 allows the Adviser to provide advisory services to the Funds without shareholder approval for an interim period following the Adviser’s change in control, Section 15(a) of the 1940 Act requires the Adviser to enter into a written contract with the Trust that has been approved by the vote of a majority of the outstanding voting securities of each Fund, in order for the Adviser to provide advisory services to that Fund. Accordingly, at a meeting held on March 14, 2018, the Board, including all of the Independent Trustees, approved a new investment advisory agreement between the Trust, on behalf of each Fund, and the Adviser (the “New Agreement”) that will take effect upon its approval by Fund shareholders. The New Agreement has the same terms and advisory fees as, and otherwise does not materially differ from, the Prior Agreement, except with respect to its effective date. The New Agreement also has the same terms and advisory fees as, and otherwise does not materially differ from, the Interim Agreement, except with respect to its effective date and the termination provisions required by Rule 15a-4. You are being asked to approve the New Agreement, so that the Adviser can continue to provide advisory services to the Funds after the Interim Agreement terminates.

The New Agreement will not affect you as a shareholder. The Adviser will continue to provide advisory services to each Fund on the same terms, and at the same advisory fee rate, as the Adviser provided previously under the Prior Agreement. While the contributions of Mr. Richardson to the Trust were immeasurable, the Adviser has assured the Board that there will be no change in the nature or quality of the investment advisory services provided to each Fund. Mebane Faber will continue to serve as portfolio manager to each Fund, and David Pursell will continue to serve as portfolio manager for the Cambria Core Equity ETF.

The New Agreement must be approved by the vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of each Fund when a quorum is present. Under the 1940 Act, the vote of a “majority of the outstanding voting securities” of a Fund means the affirmative vote of the lesser of: (a) 67% or more of the voting securities present or represented by proxy at the Meeting if the holders of more than 50% of the outstanding voting securities are present or represented by proxy at the Meeting; or (b) more than 50% of the outstanding voting securities. If the New Agreement is approved by a Fund’s shareholders, the New Agreement, with respect to such Fund, is expected to become effective on the date of the Meeting.

Description of Material Terms of the Prior Agreement, New Agreement, and Interim Agreement

The Prior Agreement, dated April 29, 2013, was approved with respect to each Fund, by the initial shareholder of each Fund, on the dates shown below, and has not been subsequently submitted to a vote of Fund shareholders. The Prior Agreement was last approved by the Board, including all of its Independent Trustees, with respect to each Fund, except Cambria Core Equity ETF, on March 16, 2017. The Board, including all of its Independent Trustees, last approved the Prior Agreement with respect to Cambria Core Equity ETF on June 15, 2017, at which time the Board approved an advisory fee reduction for the Fund.

The New Agreement will become effective with respect to each Fund upon its approval by the Fund’s shareholders. The New Agreement contains terms, including the compensation payable to the Adviser, that are identical to the terms and compensation of the Prior Agreement, except with respect to the date of the agreement. Set forth below is a summary of the material terms of the New Agreement, which is qualified in all respects by reference to the form of New Agreement included as Appendix A.

Duration and Termination.The New Agreement, like the Prior Agreement, will remain in effect for an initial period of two years, unless sooner terminated. After the initial two-year period, continuation of the New Agreement from year to year is subject to annual approval

by the Board, including a majority of the Independent Trustees. The Interim Agreement will terminate, with respect to a Fund, upon either shareholder approval of a new advisory agreement for the Fund or the 150th day following January 24, 2018, the effective date of the Interim Agreement, whichever occurs first. Each of these Agreements may be terminated at any time, without the payment of any penalty (i) by vote of a majority of the Board, (ii) by vote of a majority of the outstanding voting securities of such Fund, on 60 days’ written notice to the Adviser, or (iii) by the Adviser, on 60 days’ written notice to the Trust.

Advisory Services.The Adviser provides the same services under each of the Prior Agreement, Interim Agreement, and New Agreement (collectively, the “Agreements”). Each Agreement requires that the Adviser (i) provide a continuous investment program for each Fund, including investment research and management with respect to all securities and investments and cash equivalents in the Fund; (ii) determine, from time to time, what securities and other investments will be purchased, retained or sold by the Funds; (iii) comply with federal securities laws, directions from the Board, and limitations imposed by the Trust’s Trust Instrument, Bylaws, and the relevant Fund’s registration statement; (iv) maintain records as required by applicable law; (v) oversee the computation of the net asset value and net income of each Fund; (vi) arrange transfer agency, custody, fund administration, securities lending, accounting, and other non-distribution related services necessary for the Funds to operate; and (vi) bear the costs of all advisory and non-advisory services required to operate the Funds, except Excluded Expenses, as defined below, in exchange for a single unitary management fee.

Management Fees.Each Agreement provides that the Adviser receives a unitary management fee based on each Fund’s average daily net assets at the annual rate set forth in the table below. The fee is accrued by the Trust daily and paid monthly in arrears on the first business day of each calendar month. The aggregate amount of advisory fees paid to the Adviser by each Fund for the Fund’s fiscal year ended April 30, 2018 is also set forth in the table below.

| Aggregate | ||

| Amount of | ||

| Advisory | ||

| Fees Paid to | ||

| Advisory | the Adviser | |

| Fund | Fee Rate | by the Fund |

| Cambria Shareholder Yield ETF | 0.59% | $783,510 |

| Cambria Foreign Shareholder Yield ETF | 0.59% | $275,353 |

| Cambria Emerging Shareholder Yield ETF | 0.59% | $120,067 |

| Cambria Global Momentum ETF | 0.59% | $493,077 |

| Cambria Global Value ETF | 0.59% | $981,838 |

| Cambria Sovereign Bond ETF | 0.59% | $79,249 |

| Cambria Value and Momentum ETF | 0.59% | $80,303 |

| Cambria Global Asset Allocation ETF | 0.00% | $0 |

| Cambria Tail Risk ETF | 0.59% | $75,973 |

| Cambria Core Equity ETF | 1.05% | $1,099,8571 |

|

Brokerage Policies.Each Agreement authorizes the Adviser to select the broker-dealers that will execute the purchases and sales of securities of each Fund. Each Agreement directs the Adviser to attempt to obtain the best net result in terms of price and execution; provided that, consistent with Section 28(e) of the Securities and Exchange Act of 1934, the Adviser may allocate brokerage on behalf of a Fund to broker-dealers who provide research, analysis, advice and similar services. Further, under each Agreement, the Adviser may cause a Fund to pay to any broker-dealer who provides such services a

commission that exceeds the commission the Fund might have paid to a different broker-dealer for the same transaction, subject to the Adviser’s compliance with Section 28(e).

For each Fund’s most recently completed fiscal year or fiscal period, no Fund paid commissions on portfolio brokerage transactions to brokers who may be deemed to be affiliated persons of the Fund or the Adviser or affiliated persons of such persons.

Payment of Expenses.With respect to all Funds, except for the Cambria Emerging Shareholder Yield ETF and Cambria Global Value ETF, each Agreement provides that the Adviser shall pay all Fund expenses, except for the Fund’s advisory fee, payments under a Fund’s 12b-1 plan, brokerage expenses, acquired fund fees and expenses, taxes, interest (including borrowing costs and dividend expenses on securities sold short), litigation expense and other extraordinary expenses (including litigation to which the Trust or a Fund may be a party and indemnification of the Trustees and officers with respect thereto) (collectively, the “Excluded Expenses”). With respect to the Cambria Emerging Shareholder Yield ETF and Cambria Global Value ETF, each Agreement provides that the Adviser shall pay all Fund expenses, except for the Excluded Expenses and the Fund’s custodian expenses.

Other Provisions.Each Agreement provides that the Adviser will not be liable for any error of judgment or mistake of law or for any loss suffered by any Fund, the Trust or any of its shareholders, in connection with the matters to which the Agreement relates, exceptindependent to the extent that such a loss results from willful misfeasance, bad faithhe or gross negligence on its part in the performance of its duties or from reckless disregard by it of its obligations and duties under the Agreement. Each Agreement further provides that the Adviser agrees (i) to the limitation of shareholder liability set forth in the Trust Instrument; (ii) that the obligations assumed by the Trust under the Agreement are limited in all cases to the Trust and its assets; and (iii)she is not to seek satisfaction of any such obligations from Fund shareholders, the Board, or individual Trustees.

Cambria Investment Management, L.P., a Delaware limited partnership, is located at 2321 Rosecrans Avenue, Suite 3225, El Segundo, California 90245. The Adviser serves as investment adviser to each

Fund and is registered with the SEC under the Investment Advisers Act of 1940. The Adviser was founded in 2006 and managed approximately $769 million in ETF assets as of May 15, 2018. Mebane Faber, Pursell Management Co., LLC, Angel Reyes, IV Descendants Trust, Sofia Reyes Descendants Trust, Cambria Investments Holdings, LLC, and Cambria Investments Holdings II, LLC are limited partnersan “interested person” of the Adviser and Cambria GP, LLC is the Adviser’s general partner. Cambria GP, LLC shares the address of the Adviser. Mebane Faber is the sole manager of, and controls, Cambria GP, LLC. Cambria GP, LLC controls the Adviser as its sole general partner.

Listed below are the names and titles of each principal executive officer of Cambria. The principal business address of each officer is 2321 Rosecrans Avenue, Suite 3225, El Segundo, California 90245.

Mr. Faber serves as Trust, President and Interested Trustee on the Trust Board and portfolio manager to each Fund. Mr. Surti serves as Vice President of the Trust. Douglas Tyre serves as Chief Compliance Officer of both the Adviser and the Trust.

The Adviser does not advise any other funds that pursue investment objectives similar to those of the Funds.

Board Considerations in Approving the New Agreement

At an in-person meeting held on March 14, 2018, the Board, including the Independent Trustees, met to discuss, among other things, the Adviser’s change in control, including its impact on the Funds, and to consider, and vote on, the approval of the New Agreement with respect to each Fund. In preparation for its deliberations, the Board requested and reviewed written responses from Cambria to a due diligence questionnaire circulated on the Board’s behalf. During its deliberations, the Board received an oral presentation from Cambria and was assisted by the advice of independent legal counsel. The Board, in considering the New Agreement in the context of the Adviser’s change in control, relied upon representations from Cambria that: (i) the change in control

was not expected to result in any material changes to the nature, quality and extent of services provided to the Funds by Cambria, as discussed below; (ii) Cambria did not anticipate any material changes to its compliance program or code of ethics in connection with the change in control; and (iii) the Adviser expects Mr. Faber will continue to serve as a portfolio manager for each Fund and Mr. Pursell will continue to serve as a portfolio manager for the Cambria Core Equity ETF.

In evaluating the New Agreement, the Board reviewed information regarding Cambria’s personnel, operations, and financial condition. In addition, the Board considered that the evaluation process with respect to Cambria is an ongoing one and, in this regard, the Board considers information at each regularly scheduled meeting, including, among other things, information concerning performance and services provided by Cambria. At the meeting held on March 14, 2018, the Board considered: (1) the nature, extent and quality of the services provided to the Funds by Cambria; (2) the investment performance of Cambria with respect to each Fund as compared to the performance of an index (a Fund’s “benchmark”) and a group of funds (a Fund’s “peer group”) historically identified by Cambria as comparable to the Fund; (3) the costs of the services provided by Cambria and the profitability to Cambria derived from its relationship with the Funds; (4) the advisory fee and total expense ratio of the Funds compared to a relevant peer group of funds; (5) the extent to which economies of scale would be realized as the Funds grow and whether the advisory fee would enable investors to share in the benefits of economies of scale; (6) benefits (such as soft dollars, if any) received by Cambria and its affiliates from their relationship with the Funds; (7) Cambria’s reputation, expertise and resources in the financial markets; (8) Cambria’s investment management personnel; (9) Cambria’s operations and financial condition; (10) Cambria’s compliance program; and (11) other factors the Board deemed relevant. At the same meeting, the Board also considered the terms of the New Agreement and noted that the terms of, and the compensation payable to the Adviser under, the New Agreement are identical to those of the Prior Agreement, except with respect to the date of the agreement.

The discussion immediately below outlines in greater detail the materials and information presented to the Board in connection with its consideration and approval of the New Agreement, and the conclusions made by the Board at the meeting held on March 14, 2018 when determining to approve the New Agreement for an initial two-year term.

Nature, Extent and Quality of Services.The Board reviewed the nature, quality and extent of the overall services provided by Cambria to the Funds. In particular, the Board considered the responsibilities of Cambria under the terms of the New Agreement, recognizing that Cambria had invested significant time and effort in structuring the Trust and the Funds, obtaining the necessary exemptive relief from the Securities and Exchange Commission (“SEC”), arranging service providers, exploring various sales channels, and assessing the appeal for each Fund’s investment strategy. In addition, the Board considered that Cambria is responsible for providing investment advisory services to the Funds, monitoring compliance with each Fund’s objectives, policies and restrictions, and carrying out directives of the Board. The Board also considered the services provided by Cambria in the oversight of the Trust’s distributor, administrator, transfer agent, and custodian. The Board also discussed and considered the role of Cambria Indices, LLC as index provider to the Funds with index tracking strategies (the “Index Funds”). In addition, the Board evaluated the integrity of Cambria’s personnel, the professional qualifications and experience of the portfolio management team in managing assets, their experiences with Cambria’s services, and the adequacy of Cambria’s resources and financial condition. Based on its review, within the context of its full deliberations, the Board determined that it was satisfied with the nature, extent and quality of the services provided, and expected to be provided, to the Funds by the Adviser.

Investment Performance of the Funds.The Board noted that it considered the performance of the Funds throughout the year and reviewed each Fund’s performance for the three-month, 12-month, and since inception periods, as applicable. In this regard, among other things, the Board considered reports comparing each Fund’s total returns to the total returns of the Fund’s peer group of funds and its benchmark index. Representatives from Cambria provided information regarding and led discussions of factors impacting the performance of each Fund, outlining current market conditions and explaining their expectations and strategies for the future. The Trustees determined that each Fund’s performance was satisfactory, or, where the Fund’s performance was materially below its benchmark and/or peer group, the Trustees were satisfied by the reasons for the underperformance and/or the steps taken by Cambria in an effort to improve the Fund’s performance. With respect to the Index Funds, the Board also considered the quality of the index each Index Fund seeks to track, each Index Fund’s tracking error relative to its underlying index, and Cambria’s representation that each Index Fund’s tracking error met the

expectations described in the SEC exemptive order on which Cambria and the Funds rely to operate as ETFs. The Board also considered each Fund’s portfolio turnover rate. Based on this information, the Board concluded that it was satisfied with the investment results that the Adviser had been able to achieve for the Funds.

Comparative Fees and Expenses.The Board considered each Fund’s advisory fees in relation to the estimated costs of the advisory and related services provided by Cambria. The Trustees noted that each Fund charges a unitary advisory fee through which, Cambria, not the Funds, is responsible for paying many of the expenses necessary to service the Funds, including the expenses of other service providers. In considering the advisory fees, the Board reviewed and considered the fees in light of the nature, quality and extent of the services provided by Cambria. Because the Funds charge unitary advisory fees, the Board considered how the Funds’ total expense ratios compared to those of the funds in their peer groups. After comparing expense ratios, the Board noted that each Fund’s total expense ratio was generally consistent with the range of total expense ratios charged by its peer group of funds. The Board also considered Cambria’s representation that it would continue to monitor the Funds’ expense ratios as compared to those of their peer groups and seek to ensure that the Funds remain competitive. Based on its review, in the context of its full deliberations, the Board concluded for each Fund that the advisory fees appeared reasonable in light of the services rendered.

Costs and Profitability.The Board then considered the profits realized by Cambria in connection with providing services to the Funds. The Board reviewed profit and loss information provided by Cambria with respect to each of the Funds. In particular, the Board noted Cambria’s representation of its long-term commitment to the success of the Funds and the unitary fee structure under which Cambria bears the risk that the Funds’ expenses may increase. The Board further considered the costs associated with the personnel, systems and equipment necessary to manage the Funds and to meet the regulatory and compliance requirements adopted by the SEC and other regulatory bodies as well as other expenses Cambria pays in accordance with the Agreements. The Board also considered how Cambria’s profitability was affected by factors such as its organizational structure and method for allocating expenses. Based on its review, in the context of its full deliberations, the Board concluded that Cambria’s profitability with respect to the Funds appeared reasonable in light of the services Cambria rendered to the Funds.

Other Benefits.The Board then considered the extent to which Cambria derives ancillary benefits from the Funds’ operations. The Board discussed the potential benefits to Cambria resulting from its ability to use the Funds’ assets to engage in soft dollar transactions. The Board noted that Cambria did not have any affiliates that would benefit from the Funds’ operations. The Board reviewed the degree to which Cambria may receive compensation from the Funds based upon a Fund’s investment in other Cambria ETFs. The Board also considered that Cambria, not the applicable Index Fund, pays any licensing fees attributable to underlying Cambria indices to Cambria’s affiliated index provider.

Economies of Scale.The Board next considered the absence of breakpoints in Cambria’s fee schedule for each Fund and reviewed information regarding the extent to which economies of scale or other efficiencies may result from increases in each Fund’s asset levels. The Board determined that it is difficult to predict when economies of scale might be realized for Cambria and the Funds, many of which launched recently. The Board, thus, determined to monitor potential economies of scale, as well as the appropriateness of introducing breakpoints, as assets managed by each Fund grow larger.

Approval of the New Agreement.Based on the Board’s deliberations and its evaluation of the information described above and other factors and information it believed relevant in the exercise of its reasonable business judgment, the Board, including all of the Independent Trustees, with the assistance of Fund counsel, unanimously concluded that the terms of the New Agreement, including the fees to be paid thereunder, were fair and reasonable and agreed to approve the New Agreement for an initial term of two years and recommend the approval of the New Agreement to the Funds’ shareholders. In its deliberations, the Board did not identify any absence of information as material to its decision, or any particular factor (or conclusion with respect thereto) or single piece of information that was all-important, controlling or determinative of its decision, but considered all of the factors together, and each Trustee may have attributed different weights to the various factors (and conclusions with respect thereto) and information.

The Board of Trustees unanimously recommends thatFund shareholders vote “FOR” Proposal 1.

PROPOSAL 2: ELECTION OF TRUSTEE

As noted above, Eric Richardson, the Board’s only Interested Trustee, passed away on January 24, 2018. At a meeting held on February 7, 2018, the Board appointed Mebane Faber to serve as the Trust’s President and as the Board’s Interested Trustee. Mr. Faber, the co-founder and chief investment officer of the Adviser, has served as the portfolio manager to each of the Funds since their inception and the Trust’s Vice President from the Trust’s inception until his appointment as President. In connection with his appointment to the Board, the Independent Trustees also reviewed Mr. Faber’s biographical information, prior experience, and other factors they deemed relevant.

The Board consists of three Trustees: Mr. Faber and two Independent Trustees: Eric Leake and Dennis G. Schmal. The Independent Trustees are not “interested persons” as that term is defined in the 1940 Act.Act (“Independent Trustee”). Mr. Richardson, as the Trust’s sole initial Trustee, appointed the two Independent TrusteesSchmal was elected to the Board by unanimous written consent at the inceptioninitial shareholder of the Trust at the time of the Trust’s organization; Mr. Faber was elected by shareholders of the Trust at a special meeting of shareholders held on June 22, 2018; and Mr. Venuto was appointed as a Trustee of the initial shareholder approved their appointment as Trustees.Trust effective January 1, 2019. Each Independent Trustee has been serving as a Trustee continuously since his election.election or appointment.

Section 16(a)Mr. Venuto, a current Independent Trustee, is also the co-founder and chief investment officer of Toroso as well as an equity owner of Toroso. As a result, if Toroso becomes an investment sub-adviser to the Funds, as described in Proposal 2, Mr. Venuto will become an interested person of the Trust, and an interested trustee within the meaning of the 1940 Act. Given his relationship with Toroso, Mr. Venuto has submitted, and the Board has accepted, his resignation as a Trustee, which will become effective upon shareholder approval of the election of a new independent trustee.

With Mr. Venuto resigning as a Trustee, the Board would be left with two trustees — one “interested trustee” and one Independent Trustee. While this is permissible under the 1940 Act, restrictsCambria and the Board believe that it is in the best interest of the Funds and their respective shareholders to elect additional Independent Trustees. Not only will this provide the Board with additional resources and expertise, but it will also provide two additional Trustees who are independent of Cambria and Toroso. If shareholders approve Proposals 1A and 1B, the Board will be comprised of four Trustees, 75% of whom would be Independent Trustees. Cambria and the Board believe that the increase in Independent Trustees from two-thirds to three-quarters of the Board will enhance the independence and effectiveness of the Board and improve its ability to protect the interests of the Funds and their shareholders.

In connection with each Nominee’s consideration by the Board, the Board’s ability to appointNominating Committee and Independent Trustees reviewed each Nominee’s biographical information, experiences, and other factors they deemed relevant. Based on these considerations, and the information provided by the Nominees, the Nominating Committee has recommended the nomination of Messrs. Roche and Turner as new Trusteesindependent trustees to the full Board, unless immediately after such appointment at least two-thirds ofand the Trustees then holding office have been elected by shareholders of the Trust. Presently, two-thirds of the Trustees have been elected by shareholders. The Board proposes that shareholders of the Trust elect Mebane Faber (the “Nominee”)each of the Nominees to the Board so that the Board has the flexibility to fill vacancies and appoint new Trustees in the future in compliance with the 1940 Act and without the expenseBoard.

4

Table of conducting additional shareholder meetings.Contents

Shareholders of record of each Fund will vote together as a single class with respect to the election of each Nominee.

The persons named as proxies intend, in the Nominee. If elected, the Nominee will serve in accordance with the Trust Instrument and Bylawsabsence of contrary instructions, to vote all proxies on behalf of the Trust. Further,shareholders for the election of the Nominees. The Nominees have consented to being named in this Proxy Statement. However, if the Nominee is elected, all Trustees onNominees should become unavailable for election, due to events not known or anticipated, the Board will have been elected by Fund shareholders.

Mr. Faber has indicated that he is able and willing to continue to servepersons named as Trustee if elected. If for any reason Mr. Faber becomes unable to serve before the Meeting, proxies will be votedvote for a substitute nominated bysuch other nominee as the current Board unless a shareholder instructs otherwise. If Fund shareholders do not elect Mr. Faber, he would continue serving on the Trust’s Board but would not be considered to have been elected by Fund shareholders. This could cause another proxy solicitation to be required to fill a Board vacancy in the future. Such additional proxy solicitation will not be needed if Mr. Faber is elected at the Meeting.may recommend.

TheIf a quorum is present, the affirmative vote of a plurality of all outstanding shares of the Trust voting together, and notvoted in person or by separate Fund, at the Meetingproxy is required for the election of a Nominee. Shareholders of the Nominee. A pluralityFunds of the Trust will vote means thattogether as a single class and the person receivingvoting power of the highest numbershares of votesthe Funds will be elected, regardless of whether that person receives a majoritycounted together in determining the results of the votes cast. Therefore,voting for the Nominee will be elected as Trustee if he receives more “FOR” votes than any other nominee (even if the Nominee receives less than a majority of the votes cast), provided a quorum is present. Under a plurality vote, the majority of Fund shareholders could withhold approval of the Nominee’s election, but if quorum is present, the Nominee could be elected with a single “FOR” vote, so long as no other nominee receives any “FOR” votes.proposal.

Information Regarding the Nominee and the Trust’s Other Trustees and OfficersNominees

The business and affairs of the Trust are managed by its officers under the oversight of its Board. The Board sets broad policies for the Trust and may appoint Trust officers. The Board oversees the performance of the Adviser and the Trust’s other service providers. Each Trustee serves until his or her successor is duly elected or appointed and qualified. The Board is comprised of three Trustees. One Trustee and one Officer of the Trust are officers or employees of the Adviser.

The Nominee

The following table contains the name and birth year of the Nominee, positionsNominees, position(s) and length of service with the Trust, principal occupation held during the past five years, any other directorships held by the Nominee,Nominees, and the number of Funds overseen by the Nominee. Unless noted otherwise, theThe address of each Trustee and Officerthe Nominees is: c/o Cambria ETF Trust, 2321 Rosecrans3300 Highland Avenue, Suite 3225, El Segundo,Manhattan Beach, California 90245.90266.

Name and | ||||

Year of Birth |

| Principal | Number of | Other Directorships |

Trustee Nominees | ||||

Cullen Roche | Trustee; no set term | Founder and Chief Investment Officer, Orcam Financial Group, d/b/a Discipline Funds (investment firm) (2012 – present). | 12 | None |

Thomas (Taz) M. Turner, Jr.* | Trustee; no set term | Founder and Portfolio Manager, Southshore Capital Partners (investment firm) (since 2010). | 12 | Chairman and Chief Executive Officer, CordovaCann Inc. (Canadian-domiciled cannabis retail) (since 2017). |

* Messrs. Faber and Turner are first cousins, but they are not immediate family members for the purpose of identifying “interested persons” of the Trust as defined in the 1940 Act.

5

The following tables contain similar information about the Trustees who will remain members of the Board after the Meeting as well as Trust officers.

Remaining Trustees

Name and | Position(s) Held with Trust, | Principal | Number of | Other Directorships Held by Trustee |

Interested Trustee* | ||||

Mebane | Chairperson of the Board, Trustee, and President of the Trust since 2018; | Co-Founder and Chief Investment Officer (2006 – present), Chief Executive Officer (2018 – present), Cambria Investment Management, L.P. | 12 | None |

Remaining Trustees and Trust Officers

The following table contains similar information about the remaining Trustees and Trust officers.

| ||||||||

Dennis G. Schmal YOB: 1947 |

| |||||||

| Trustee since 2013; no set term | Retired. | 12 | ||||||

Trustee, | ||||||||

* Mr. Faber is an “interested person,” as defined by the Investment Company Act, because of his employment with and ownership interest in Cambria.

** Messrs. Faber and Turner are first cousins, but they are not immediate family members for the purpose of identifying “interested persons” of the Trust as defined in the 1940 Act.

6

Officers

Name and Year | ||

| of Birth | Position(s) Held with Trust, | Principal Occupation During Past 5 Years |

| ||

YOB: | Treasurer and Principal Financial Officer since | Fund |

Jonathan Keetz | Vice President since | Chief Operating Officer |

Douglas Tyre | Chief Compliance Officer since May 2018; no set term | Senior Principal Consultant, ACA Group, Compliance (May 2022 – present); Compliance Director, Foreside Financial Group, LLC (April 2022 – May 2022); Compliance Director (2019 – 2022), Assistant Compliance Director |

Individual Trustee and Nominee Qualifications

TheAt the recommendation of the Nominating Committee, the Board has concluded that each of the Trustees, includingNominees and the Nominee,remaining Trustees should serve on the Board because of their abilities to review and understand information about the Trust and the Funds provided by management, to identify and request other information hethey may deem relevant to the performance of histheir duties, to question management and other service providers regarding material factors bearing on the management and administration of the Funds, and to exercise their business judgment in a manner that serves the best interests of the Funds and their respective shareholders. The Board has determined that each Nominee and each Trustee, on an individual basis and in combination with the other Trustees, is qualified to serve, and should serve, on the Board. To make this determination the Board considered a variety of criteria, none of which in isolation was controlling. Among other things, the Board considered each Nominee’s and each Trustee’s experience, qualifications, attributes and skills.

Table of Contentsskills, as described below.

Eric Leake:Nominees

Cullen Roche: Mr. LeakeRoche has extensive experience in the investment management industry, including as a partnerportfolio manager and chief investment officeran author well-known for his research on the monetary system and portfolio construction. He is the founder and Chief Investment Officer of an SEC-registeredinvestment adviser.adviser, and he serves as the portfolio manager for the firm’s exchange-traded fund. Mr. Roche has consulted on portfolio management as a discretionary and non-discretionary advisor for over 15 years.

Taz Turner: Mr. Turner has extensive experience in the investment management industry, including over 20 years of experience investing in global equity and debt securities in both public and private markets on behalf of various

7

hedge funds and private equity firms. In 2010, he founded the investment firm Southshore Capital Partners, and he serves as the firm’s General Partner and portfolio manager for the firm’s global investment fund.

Remaining Trustees

Dennis G. Schmal:Schmal (Independent Trustee):Mr. Schmal has extensive experience in the investment management industry, including as a member of senior management of the investment company audit practice at a large public accounting firm, as well as service on multiple boards of directors overseeing public companies, registered investment companies and private companies and funds.

Mebane Faber:Faber (Interested Trustee): Mr. Faber has extensive experience in the investment management industry, including as a portfolio manager, an author of multiple investment strategy books, and host of his own wealth management podcast.

The following table shows the dollar amount range of each Trustee’s “beneficial ownership” of shares of the Funds and each series of the Trust as of the end of the most recently completed calendar year. Dollar amount ranges disclosed are established by the SEC. “Beneficial ownership” is determined in accordance with Rule 16a-1(a)16a-1(a)(2) under the 1934 Act.

Name of Trustee | Name of Fund | Dollar Range of | Aggregate Dollar Range of | |||

Interested Trustee | ||||||

Mebane Faber | Shareholder Yield ETF | |||||

Foreign Shareholder Yield ETF Emerging Shareholder Yield ETF Global Value ETF Global Momentum ETF Value and Momentum ETF Global Asset Allocation ETF Tail Risk ETF Trinity ETF Global Real Estate ETF Global Tail Risk ETF | $10,001 – $50,000 | Over $100,000 | ||||

Independent Trustees and Nominees | ||||||

| ||||||

| Dennis G. Schmal | n/a | None | None | |||

Cullen Roche | n/a | None | None | |||

Taz Turner | n/a | None | None | |||

As8

Board Structure and Responsibilities

Mr. Faber is considered to be an Interested Trustee and serves as Chairman of the Board. The Chairman’s responsibilities include: setting an agenda for each meeting of the Board; presiding at all meetings of the Board and, if present, meetings of the Independent Trustees; and, serving as a liaison between the other Trustees, Trust officers, management personnel and counsel.

The Board believes that having an interested Chairman, who is familiar with the AdviserCambria and its operations, while also having two-thirdsat least two-thirds of the Board composed of Independent Trustees, strikes an appropriate balance that allows the Board to benefit from the insights and perspective of a representative of management while empowering the Independent Trustees with the ultimate decision-makingdecision-making authority. The Board has not appointed a lead Independent Trustee at this time. The Board does not believe that an independent Chairman or lead Independent Trustee would enhance the Board’s effectiveness, as the relatively small size of the Board allows for diverse viewpoints to be shared and for effective communications between and among Independent Trustees and management so that meetings proceed efficiently. Independent Trustees have effective control over the Board’s agenda because they form a majority of the Board and can request presentations and agenda topics at Board meetings.

The Board normally holds four regularly scheduled meetings each year, at least one of which is in person. The Board may hold special meetings, as needed, either in person or by telephone, to address matters arising between regular meetings. The Independent Trustees meet separately at each regularly scheduled in-personin-person meeting of the Board;Board as well as most telephonic quarterly meetings; during a portion of each such separate meeting management is not present. The Independent Trustees may also hold special meetings, as needed, either in person or by telephone.

The Board conducts a self-assessmentself-assessment on an annual basis, as part of which it considers whether the structure of the Board and its Committees is appropriate under the circumstances. Based on such self-assessment,self-assessment, among other things, the Board considers whether its current structure is appropriate. As part of this self-assessment,self-assessment, the Board considers several factors, including the number of Funds overseen by the Board, their investment objectives, and the responsibilities entrusted to the Adviser and other service providers with respect to the oversight of the day-todayday-to-day operations of the Trust and the Funds.

The Board sets broad policies for the Trust and may appoint Trust officers. The Board oversees the performance of the AdviserCambria and the Trust’s other service providers. As part of its oversight function, the Board monitors the Adviser’sCambria’s risk management program, including, as applicable, its management of investment, compliance and operational risks, through the receipt of periodic reports and presentations. The Board has not established a standing risk committee. Rather, the Board relies on Trust officers, advisory personnel and service providers to manage applicable

risks and report exceptions to the Board in order to enable it to exercise its oversight

9

responsibility. To this end, the Board receives reports from such parties at least quarterly, including, but not limited to, investment and/or performance reports, distribution reports, Rule 12b-112b-1 reports, valuation and internal controls reports. Similarly, the Board receives quarterly reports from the Trust’s chief compliance officer (“CCO”), including, but not limited to, a report on the Trust’s compliance program, and the Independent Trustees have an opportunity to meet separately each quarter with the CCO. The CCO typically provides the Board with updates regarding the Trust’s compliance policies and procedures, including any enhancements to them. The Board expects all parties, including, but not limited to, the Adviser, other service providers and the CCO, to inform the Board on an intra-quarterintra-quarter basis if a material issue arises that requires the Board’s oversight.

The Board generally exercises its oversight as a whole but has delegated certain oversight functions to an Audit Committee. The function of the Audit Committee is discussed in detail below.

Board Meetings and Standing Committees

At any meeting of the Board, a majority of the Trustees then in office must be in attendance to constitute a quorum. The Trust does not have policies with respect to the Trustees’ attendance at meetings, but as a matter of practice all of the Trustees attend the Trust’s Board and committee meetings (in person or by telephone) to the extent possible. During the fiscal year ended April 30, 2018,2023, the Board met fivefour times.

The Board currently has two standing committees: an Audit Committee and a Nominating Committee. Each Independent Trustee serves on each of these committees.

Audit Committee.The purposes of the Audit Committee are to: (1) oversee generally each Fund’s accounting and financial reporting policies and practices, their internal controls and, as appropriate, the internal controls of certain service providers; (2) oversee the quality, integrity, and objectivity of each Fund’s financial statements and the independent audit thereof; (3) assist the full Board with its oversight of the Trust’s compliance with legal and regulatory requirements that relate to each Fund’s accounting and financial reporting, internal controls and independent audits; (4) approve, prior to appointment, the engagement of the Trust’s independent auditors and, in connection therewith, to review

and evaluate the qualifications, independence and performance of the Trust’s independent auditors; and (5) act as a liaison between the Trust’s independent auditors and the full Board. The Committee operates under a written charter approved by the Board. During the fiscal year ended April 30, 2018,2023, the Audit Committee met threetwo times.

Nominating Committee.The purposes of the Nominating Committee are, among other things, to: (1) identify and recommend for nomination candidates to serve as Trustees and/or on Board committees who are not “interested persons” as defined in Section 2(a)(19) of the 1940Investment Company Act (“Interested Person”)

10

of the Trust and who meet any independence requirements of Exchange Rule 5.3(k)(1) or the applicable rule of any other exchange on which shares of the Trust are listed; (2) evaluate and make recommendations to the full Board regarding potential trustee candidates who are Interested Persons of the Trust; and (3) review periodically the workload and capabilities of the Trustees and, as the Committee deems appropriate, to make recommendations to the Board if such a review suggests that changes to the size or composition of the Board and/or its committees are warranted. The Committee operates under a written charter approved by the Board, which is included as Appendix B. The Committee does not consider potential candidates for nomination identified by shareholders; however, it may consider candidate recommendations from any source it deems appropriate, including the Board, the Adviser,Cambria, or Fundfund counsel. During the fiscal year ended April 30, 2018,2023, the Nominating Committee did not meet.met once.

The Nominating Committee considered the qualifications and experience of the Nominees and recommended to the full Board that each Nominee be elected as a new Trustee, and further recommended that each Nominee be nominated for election by the shareholders of the Trust.

The Independent Trustees determine the amount of compensation that they receive. In determining compensation for the Independent Trustees, the Independent Trustees take into account a variety of factors including, among other things, their collective significant work experience (e.g., in business and finance, government or academia). The Independent Trustees also recognize that these individuals’ advice and counsel are in demand by other organizations, that these individuals may reject other opportunities because of the time demands of their duties as Independent Trustees, and that they undertake significant legal responsibilities. The Independent Trustees also consider the compensation paid to independent board members of other registered investment company complexes of comparable size.

TheJanuary 1, 2023, the Independent Trustees are paid $10,000 per quarter for attendance at meetings of the Board and the Chairman of the Audit Committee receives an additional $1,250 per quarter. Prior to January 1, 2023, the Independent Trustees were paid $8,750 per quarter for attendance at meetings of the Board and the Chairman of the Audit Committee receivesreceived an additional $1,250 per quarter. The Trust’s officers and any interested Trustees receive no compensation directly from the Trust. All Trustees are reimbursed for their travel expenses and other reasonable out-of-pocketout-of-pocket expenses incurred in connection with attending Board meetings. The Trust does not accrue pension or retirement benefits as part of the Funds’ expenses, and Trustees are not entitled to benefits upon retirement from the Board.

11

The following table reflects the compensation paid to the current Trustees for the fiscal year ended April 30, 2018:2023:

| Total | |||

| Compensation | |||

| from the Fund | |||

| Independent | Compensation | Complex Paid | |

| Trustees | Compensation | Deferred | to Trustee* |

| Eric Leake | $33,750 | $0 | $33,750 |

| Dennis G. Schmal | $38,750 | $0 | $38,750 |

| Interested Trustee | |||

| Eric W. Richardson** | $0 | $0 | $0 |

| Mebane Faber*** | $0 | $0 | $0 |

1 Trustee compensation is allocated across the series of the Fund Complex on the basis of assets under management. Under the Funds’ Advisory Agreement, however, Cambria ultimately pays the compensation and expenses of the Trustees. 2 Mr. Faber is an “interested person,” as defined by the Investment Company Act, because of his employment with and ownership interest in Cambria.

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

|

Shareholders may send communications directly to the Trustees in writing at the address specified above under “Information Regarding the Nominee and the Trust’s Other Trustees“Trustees and Officers.”

The Board of Trustees unanimously recommends that Fund

shareholders vote “FOR” Proposals 1A and 1B.

12

PROPOSAL 2: APPROVAL OF A NEW INVESTMENT SUB-ADVISORY AGREEMENT